The Startup Founder's Guide to Alternative Financing [2025]

2 mins

Imagine you are the founder of a fast-growing startup and need capital to fuel the expansion of your business, who do you turn to?

For many years there was only one answer: banks. They were the only game in town and loans were made on their terms. However, the market is evolving and it's great news for founders.

In recent years the alternative financing market has grown in popularity and businesses are turning to this market for their funding needs. The future is bright as well, with the market expected to grow from $174bn in 2022 to $921bn by 2032, an 18.5% CAGR over the period.

If you are new to alternative financing, you’re in the right place. This alternative financing guide will help startup founders make the right financing decision for their business.

What is Alternative Financing?

Alternative financing refers to financing raised outside the traditional banking system. The alternative financing market has grown in popularity to address gaps in the traditional financing market. It includes products such as invoice factoring, venture debt, and revenue-based financing.

The Emergence of Alternative Financing

The lending market used to be dominated by, well, banks! However, the banking industry has gone through a meaningful transition over time, most notably with major regulatory changes following the Great Financial Crisis in 2008.

After a near-collapse of the US Banking system, a suite of regulations led by the Dodd-Frank Wall Street Reform and Consumer Protection Act was put in place to reduce risk-taking and ensure stability in the banking system.

The increased regulatory pressure on the banking system saw traditional banks withdraw from small business lending, leaving an air pocket for financing in the market. The alternative finance market stepped in to address these gaps.

Alternative vs Traditional Financing

Startups considering a capital raise will be familiar with the traditional financing options available to them. These include bootstrapping, friends & family, venture capital, and bank loans. These options can work well in certain instances, however, alternative finance provides a wider range of options with many benefits which may be a better fit for startups.

Equity vs Non-equity Financing

Equity financing involves securing capital in exchange for an ownership stake in a business. This is typically raised from the venture capital community, who may additionally request some operational control or influence in the business.

Conversely, non-equity financing is non-dilutive and refers to securing capital in exchange for future payments over time. This form of financing includes many types such as bank loans, venture debt, and revenue-based financing.

How Does Alternative Financing Work?

Alternative financing connects borrowers and lenders outside the traditional banking system, often through technology-enabled channels such as websites and apps.

Generally, the process involves engaging with a financing partner, determining the type of financing desired, submitting an application, and working through an approval process to secure funding.

Benefits of Alternative Financing

Alternative financing is innovative, flexible, and dynamic–much like the customers it serves. It can have many benefits to startup firms relative to the traditional market. Startups are turning to alternative financing in large numbers, driven by the evolving needs of and challenges faced by startups.

Technology-enabled and facilitated through online platforms, alternative financing can be simpler, faster, and more flexible. Furthermore, the risk-taking appetite of alternative lenders is more aligned with the profile of startups relative to traditional banks which can result in lower-cost loans to the customer.

Read more about our perspectives on alternative financing for founders in today’s market and how it can help startups grow faser.

Avoiding Higher Interest Rates

Bank loans typically require high credit scores and come with fixed interest payments which can be a burden on startups with little operating history and irregular cash flows. Alternative financing structures can achieve lower interest rates vs. bank loans primarily through two channels.

First, there is a more flexible underwriting process in making loans that leverages additional factors to determine creditworthiness as opposed to relying on credit scores. Second, there is more flexibility in how revenue is assessed.

A common example of this is revenue-based financing. Lenders assess startups on the basis of their future recurring revenue. This is beneficial for startups and early-stage businesses who have subscription-revenue, such as SaaS models looking to scale.

Faster Application & Disbursement Process

Another key benefit of alternative financing is the speed at which you can secure funding. Startup founders know business is fast-moving and financing needs can arise quickly. The traditional bank loan process can be lengthy with lots of paperwork.

Alternative financing can offer streamlined application processes and rapid access to funds. For example, Efficient Capital Labs provides a seamless customer experience with funding received within 72 hours following an online application.

Fewer Approval Requirements

Traditional bank loan approval processes can be cumbersome, with lengthy diligence processes, documentation, and lawyer and accountant involvement. They often require warrants and physical assets to be used as collateral. The simplified tech-enabled experience offered by alternative finance partners can do away with much of the “red tape.”

Streamlined and transparent application processes ensure the best experience for founders and free up time for them to focus on running their startup.

Future-Looking Terms

Finally, alternative financing arrangements offer more flexibility in terms. Banks seek to fit small businesses into a box that works for them, often offering inflexible term sheets.

Alternative financing has a wide array of structures that allow a startup to secure capital on its own terms. For example, a startup SaaS business may have contracts for $2 M of business, but have only $200,000 in the bank. This business might turn to revenue-based finance to satisfy a cashflow timing mismatch - by providing growth capital upfront against future contracts.

Alternative Financing Options & Example

Startups are turning to alternative financing arrangements more frequently given their suite of benefits. Below we examine a few options available to startups and their pros and cons.

Revenue-based Financing

Revenue-based financing is a type of financing where companies borrow money upfront on the basis of future revenue until the amount is repaid. It’s akin to debt conceptually in that it includes a borrowing of dollars upfront, with smaller payments over time and a repayment of the dollars at the end.

In many but not all cases, the smaller payments over time take the form of a percentage of revenue, rather than predetermined fixed-interest payments.

Pros of Revenue-based Financing:

- No Equity Dilution: Venture Capital leads to equity dilution, often of 20%+ of the company’s shares in each round. Venture Debt also tends to include the option for the lender to purchase shares at a pre-agreed price. In comparison, RBF allows founders to retain control and ownership.

- No Interest Accumulation: Unlike Venture Debt or Bank Loans, RBF does not accumulate interest, providing a more predictable repayment pathway. There is a transparent and predetermined fee for the funding.

- Alignment with Business Growth: RBF investors enable companies to grow flexibly. Often Venture Capital funding comes with growth targets and other requirements that may not align with a founder’s own judgment about the pace at which their company should grow. Companies that take RBF can extend their runway on their own growth terms.

- Speed of Funding: RBF can often be secured quicker with fewer hurdles than other financing options. Typically RBF providers can offer funding in as little as 3 days to 2 weeks.

- Preservation of Control: Founders maintain control and decision-making power with RBF, unlike some VC arrangements that may require board seats or influence over major company decisions.

Potential Revenue-based Financing Limitations:

- Higher Cost of Capital for Mature Businesses: While offering additional flexibility, in some cases RBF arrangements can result in higher all-in costs of capital than bank loan financing. This is particularly true for large, mature businesses with access to low-rate bank loans and public bond markets. These markets are deep and efficient, and the breadth of capital being lent to them can bring borrowing costs down. However, only larger more mature businesses have access to these markets given their risk profile, so early-stage startups may not be able to access them. It is important to compare the all-in cost of various options and consult with a professional to determine the best fit for your business.

- Revenue is Required: Given the nature of the financing arrangement where payments are made on the basis of future revenue, this form of financing is only suitable for revenue-generating startups. A pre-product or pre-revenue startup would need to rely on the venture capital complex to underwrite the business based on the founder and idea quality.

- Short-Term Repayments: Venture capital funds may invest in a company, and wait 5-10 years to see a return. With revenue-based finance, companies must begin repayments in the present. This has implications for cashflow over the present year time horizon.

In the SaaS market specifically, there has been positive momentum in the RBF space given the challenging VC market in 2022-2023 as rates have risen sharply in the United States.

If you’re a founder looking to access the benefits of revenue-based financing, Efficient Capital Labs is the best solution.

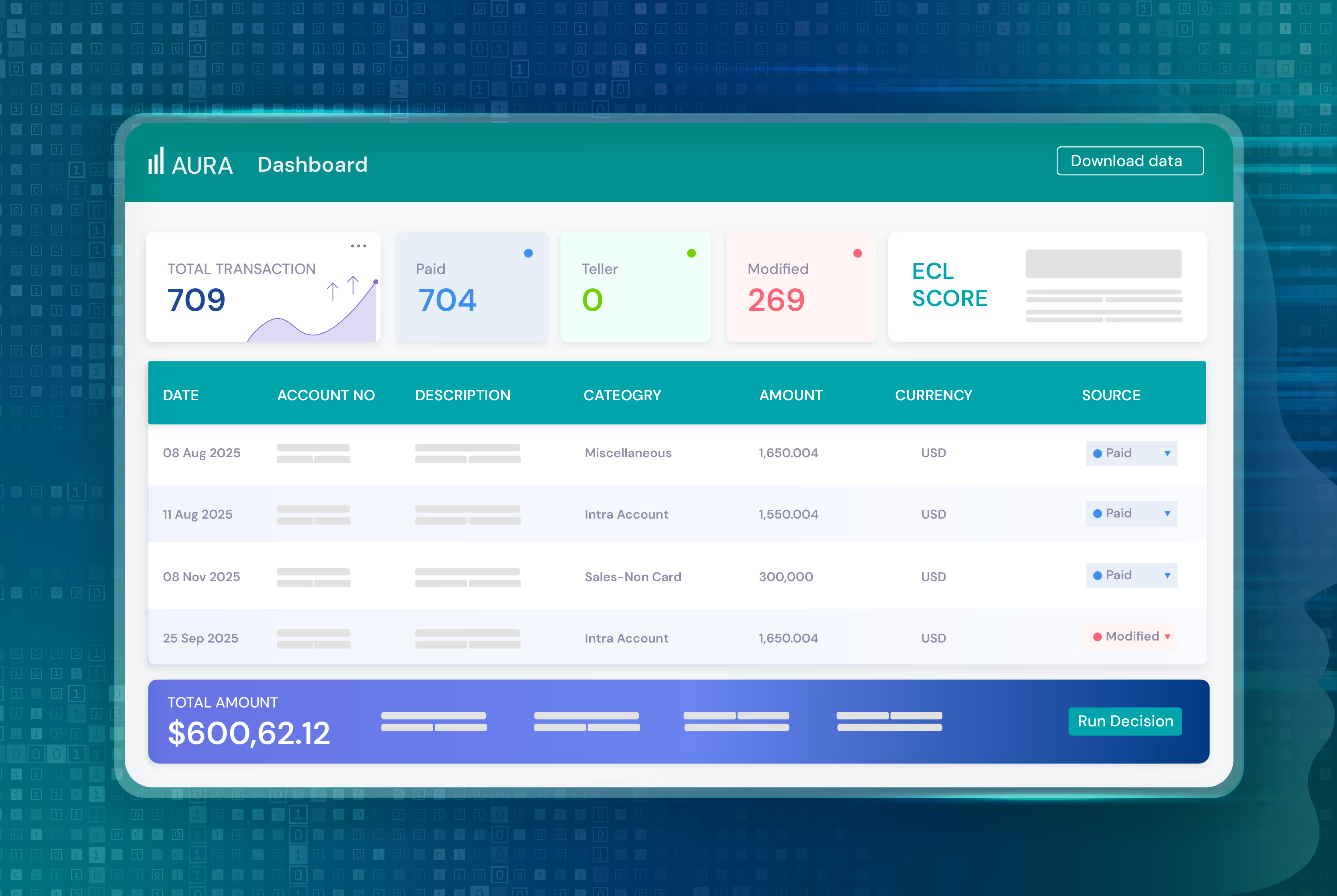

Efficient Capital Labs is a revenue-based financing provider that offers funding to SaaS businesses that operate in the B2B sector. The platform finances companies from its own $100M debt facility–differentiating it from other lenders and enabling low rates and greater flexibility.

ECL’s customers range from early-stage startups with annual revenue as low as $100Ko, to larger and growth-stage ventures and has a significant presence in funding global SaaS companies. Many of these companies have an operational base in a country like India or Singapore and generate revenue from other markets like the USA.

Efficient Capital Labs is an active financing partner to SaaS businesses, having financed $25M to date with 65% of customers returning for additional funds.

Peer-to-peer Lending

Peer-to-peer lending is a financial-technology-enabled marketplace that seeks to directly connect individual borrowers and lenders. As an abstract analogy, think about it like going to your swap meet to buy a bicycle from your neighbor instead of going to a used bike store.

You may be able to find a bike for a better price, however, it comes with more risk as it will not have been inspected and serviced by the bike store.

Peer-to-peer lending seeks to eliminate the middleman, typically a bank, from the borrowing and investing experience. Individual borrowers can access a pool of capital at lower interest rates as they are not paying for a bank’s underwriting services or balance sheet.

Individual lenders can invest in small businesses and areas they could not otherwise access through the public stock or bond markets.

In a startup context, this form of fundraising can allow businesses to connect to a pool of capital from individuals who are excited about their product and business. It is less bureaucratic than the venture capital space and breaks down barriers to entry for passionate founders and investors alike.

Pros of Peer-to-peer Lending:

- Capital access: Access to a different pool of capital from supporters of your business

- Investor Connection: More direct connection with investor base, eliminates bureaucracy of middlemen

Cons of Peer-to-peer Lending:

- Less reliability: Less reliable or permanent form of capital given the individual nature of the investor base

- Higher risk: High degree of underwriting risk for lenders given the lack of standardized process and institutional underwriting standards

Venture Debt

Venture debt is a form of debt financing provided by the venture capital complex as opposed to the traditional banking system. Venture debt providers are sophisticated institutions with a higher risk appetite vs. banks and more flexibility in transaction structuring and seniority.

Venture debt can come in many forms such as subordinated loans or asset-backed credit facilities.

Venture Debt Pros:

- Sophisticated institutional partners: Venture debt providers are sophisticated investment firms with deep industry and capital markets knowledge. This makes them ideal partners for businesses with complex needs such as specialty finance startups, whose inventory itself may be financial products such as personal or auto loans. The complexity of these businesses requires a sophisticated partner to understand the underwriting risk and provide well-priced capital.

- Permanent capital: Given their institutional nature and pool of long-term capital, venture firms can offer longer-term debt financing for borrowers who require arrangements for multi-year periods.

- Flexible transaction structures: Venture debt providers focus on the startup landscape and understand the changing needs of growing businesses. Their expertise and capital base allow them to be flexible in structuring terms relative to a traditional bank loan.

Venture Debt Cons:

- Higher interest rates: Given their subordinated position in the capital stack vs. a senior lender, venture debt firms may charge higher interest rates to compensate for their underwriting risk. This can result in higher interest rates for borrowers.

- Founder may lose equity via warrants: Venture debt providers may seek additional compensation for the risk on their loans. Warrants may be embedded in financing agreements as additional compensation for the lender. Warrants give the lender an option to purchase a portion of the borrower's stock at a predetermined price in the future. This allows venture debt firms to participate in the equity value upside but is dilutive to funders.

- Can require collateral: Venture debt firms may seek additional protection on their loans through collateralization. In this case, the borrower is required to pledge assets that may be sold for the benefit of the lender in case of default.

This mitigates risk for the lender and can thus reduce borrowing costs, but requires encumbering of assets which can reduce future flexibility for the borrower. It can also come with legal costs and ongoing collateral reporting which can be burdensome to a startup.

Invoice Factoring

Invoice factoring, also known as invoice discounting or accounts receivable financing, is a form of financing where a company sells its outstanding invoices to a third-party institution, known as a factor.

In return, the business receives upfront capital at some haircut to the collateral value (10-30% context) is a good rule of thumb. The factor then assumes the responsibility of collecting payments from the customers.

Pros of Invoice Factoring:

- Unlocks capital: By securing upfront payment for services already provided, factoring effectively monetizes capital locked up in invoices or receivables which is owed to the business but not yet paid. This additional cash flow can then be used to cover operating expenses and expand the business.

- No business credit required: Factor providers purchase invoices or accounts receivable from a business, thus their risk lies with the customer’s failure to repay as opposed to the business. Therefore there is less requirement for creditworthiness for the business which can be helpful for startups with little operating history.

- No debt incurred: Factoring is not a loan, so businesses do not incur debt. The capital received is an upfront monetization of products or services that have already been delivered, and the business doesn't need to repay the factor.

Invoice Factoring Cons:

- Costs and fees: The most obvious cost to the business is the haircut on receivable value. You may monetize $100 in receivables three months early–but only receive $70 in value from the factor. Conceptually this can be thought of as a 30% 3-month interest rate. Additionally, there can be fees associated with this type of arrangement which can lift the overall cost of capital. As with any form of financing, it’s important to consider options carefully and measure the all-in cost of capital vs. other options to find the best fit for your business.

- Customer relationships: Some customers may have mixed views on involving a third party in the collections process. These optics may be damaging to a customer relationship and hamstring future business. Founders should consider the impact on relationships in their business.

Lines of Credit

Lines of credit, or revolving credit facilities (“RCF”) can take many forms (small, large, short-term, long-term, unsecured, asset-backed) and be sourced from different lender complexes (traditional banks, venture firms). Let’s consider the most common form, a senior unsecured line of credit from a bank in this example.

A line of credit can be thought of as a credit card for a business. It must be repaid before other borrowings, there is a set monthly spending limit, interest rate, and penalty for late payments. It is a useful tool for many businesses to be flexible in servicing ongoing expenses which can be concentrated around month-end, quarter-end, and year-end calendar dates.

It often forms a core component of the capital stack for small and large businesses alike.

Lines of Credit Pros:

- Flexible cash once secured: Once an arrangement has been reached, the structure offered by a line of credit is quite flexible and helpful for businesses in managing ongoing expenses. Just like a credit card, the cash is there when you need it and not when you don’t.

- Relationship entry with bank: Banks often think of credit lines as a “relationship” product with businesses. They tend to be underpriced relative to the balance sheet cost to the bank but represent an entry point into ancillary products and services offered by the bank. From a borrower's perspective it can be helpful to access the suite of bank account and payments services offered by a bank and a line of credit can be a good introduction.

- Lower cost of capital: Given their seniority in the capital stack (from the flexibility point, RCFs must be paid back before other borrowings), interest rates can be lower than junior venture debt. Furthermore, RCFs are priced on both “drawn” and “undrawn” funds. A $5M RCF is an agreement where a business has the ability to borrow up to $5M if they would like. Dollars that are borrowed for a time period are referred to as drawn funds, and come with an interest rate; dollars that are not borrowed, but could be, are referred to as undrawn funds, and come with a lower interest rate. The seniority and low rates on undrawn funds can enable a lower cost of capital for borrowers.

Lines of Credit Cons:

- Long approval process: Similar to a bank loan, the approval process for an RCF with a bank can be lengthy and require due diligence, credit assessment, lawyers, accountants, and documentation. This can be a cumbersome process for a startup.

- Requires credit history: Again, similar to the bank loan process, a bank RCF requires underwriting from a bank that will look for quality credit history to get comfortable with the risk they take. This can be challenging for an early-stage startup with little to no operating or credit history.

Business or Merchant Cash Advances

Business or Merchant Cash Advances (“MCA”) are a financing arrangement where a business receives a lump sum advance against future sales, plus fees. This type of financing is frequently used in industries with variable revenue like retail, hospitality, and medical services.

For example, a retail business may face significant seasonality, with a majority of sales around the holidays. In this case, they can procure funding upfront to prepare for the busy time in exchange for a percentage of sales during this elevated period.

MCA Pros:

- Quick access to funds: MCAs allow businesses to access capital quickly. The application process is typically faster than traditional loans, making it suitable for businesses with urgent financial needs.

- Flexible repayment: Repayments are based on a percentage of daily credit card sales. This means that during slower periods, when sales are lower, the repayment amount decreases proportionally, providing flexibility.

- Higher approval: Merchant cash advances may have higher approval rates compared to traditional loans because they are based more on daily sales volume than on credit scores or collateral.

MCA Cons:

- High costs and fees: MCAs often come with high costs and fees which give an overall high cost of capital. The factor rate, which represents the total repayment amount, can be much higher than the initial advance. This makes MCAs a relatively expensive form of financing.

- Impact on profit margins: Similar to the consideration for an RBF, the percentage of daily sales taken for repayment can reduce margins. In a scaling startup, this can reduce operating leverage. Businesses need to carefully assess their situation and options to determine if an MCA is justifiable.

Crowdfunding

Crowdfunding involves collecting small contributions from a large number of people to fund a project or business. It typically takes place on an online platform where individuals and businesses can present their ideas and seek financial support from a broad audience.

GoFundMe and Kickstarter are household names in crowdfunding in the United States.

Crowdfunding Pros:

- Access to diverse capital: Similar to P2P lending, crowdfunding looks to directly connect individual investors & borrowers. This allows a startup to access a diverse pool of capital that would not otherwise be available.

- Proof of concept: Startups need to find a viable business model with proven demand for their product. Successfully raising capital from a diverse group of individuals is evidence of interest in the product and can be a positive sign for true demand in the market.

- Human capital: Fundraising from individuals has many qualitative vs. quantitative (numbers, cost, etc.) human benefits. A successful crowdfunding campaign reaches a large audience and carries a marketing benefit. Backers can additionally provide insight and feedback during the crowdfunding phase before launch. Finally, crowdfunding can attract industry leaders and potential business partners.

Crowdfunding Cons:

- Competitive and crowded: Given their low risk and barriers to entry, crowdfunding platforms are highly competitive. Attracting attention requires effective marketing, a compelling story, and sometimes a pre-existing network. Not all projects receive the desired funding, and some may struggle to attract backers if they fail to differentiate themselves or communicate their value effectively.

- Fulfillment challenges: As they are typically pre-product in nature, crowdfunded challenges can face difficulties in fulfilling promises made to backers around the delivered product during the fundraising stage. This can carry reputational risk for the business and founders themselves.

- Retail focus: The typical crowdfunded startup is selling a physical product - which is more simple to market to the individual. There is limited potential for crowdfunding for other types of businesses.

Alternative Financing Best Practices for Startups

Selecting a financing source for your business is an important decision and should be made carefully. As we’ve discussed, alternative financing is growing in popularity and can have numerous benefits for startups during their growth journey.

When making a financing decision it is crucial to understand the options and needs of your business to determine the best fit.

- Research Alternative Financing Lenders

The alternative financing landscape is broad and developing rapidly. Selecting an alternative financing partner is an important part of the financing process. There are financing partners of many sizes, backgrounds, and specialties.

- Know What You Have to Offer

Any lender will look to do some form of diligence when determining the creditworthiness of a borrower. To the extent you can provide organized information to a lender, it can make the process a lot smoother.

Information on your historical operating / financial performance, projected operating/financial performance, credit history, and collateral availability will be helpful for financing partners.

- Determine What You Need (& Want)

Only you know what your business needs. Before engaging with a financing partner, paint a clear picture of the key features and constraints you have. Consider the duration of borrowing, desired repayment terms (fixed vs. flexible), prioritization of cost of capital vs. features, speed to funding–and if you’re willing to give up equity in your business.

Having a well-defined list of features and constraints will help you and your financing partner optimize a funding option based on your priorities.

- Choose the Right Alternative Financing Option for You

Following careful research, preparation, and determination of business needs, the final step is to engage with a financing partner and select the alternative financing option which best fits your business.

Smart funding means the potential for global growth. One option that’s a great fit for startups is revenue-based financing (RBF). RBF allows founders to receive cash upfront on the basis of their annual recurring revenue (ARR) – but without diluting their equity.

Efficient Capital Labs can be a valuable partner for you here, providing up to $1.5 million in funding to startups within three days of applying so you can act quickly when opportunities arise.

With ECL, you can:

- Receive up to 65% of your projected revenue as upfront capital

- Extend your cash runway

- Get a better valuation on your next fundraise

- Access an easy 12-month repayment term with a transparent, fixed annual fee between 10%-12%

- Raise future equity on your terms and timeline

- Complete your last mile to profitability

Calculate your funding eligibility now

Learn More About Alternative Financing

Let’s explore a few more general questions founders may have when considering their options.

What is considered alternative financing?

Alternative financing represents financing agreements made outside of the traditional banking system. Typical bank financing instruments to small businesses include bank loans and lines of credit. Alternative financing instruments include arrangements such as revenue-based financing, venture debt, and invoice factoring.

What is an example of an alternative financial system?

An alternative financial system is any financial marketplace which exists outside of the traditional banking system. An example of an alternative financial system is the venture capital market, where businesses raise equity funding directly from private institutions as opposed to going to a bank for a loan.

What is the alternative financing model?

The alternative financing model refers to funding relationships between businesses & non-bank institutions. In this model, non-bank lenders such as private investment firms provide capital to small businesses under various types of financing arrangements.

What is the most popular form of alternative financing?

There are many forms of alternative financing which are popular with different types of businesses. In the startup SaaS space, revenue-based financing is particularly popular as it is a good fit for the cash flow profile of software companies.

Access the Best Alternative Financing Company for Your Startup

While alternative financing offers many benefits for startups, it's important for entrepreneurs to carefully evaluate the specific terms, costs, and implications associated with each method. Each startup is different, and choosing the right financing option requires consideration of the business's goals, growth stage, and financial situation.

Revenue-based financing with Efficient Capital Labs means you not only get the capital you need–but also a financial partner committed to seeing your business thrive.

If you're looking to grow your company, or have additional questions on alternative financing for founders, get in touch today.

Heading 1

Heading 2

Heading 3

Heading 4

Heading 5

Heading 6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Block quote

Ordered list

- Item 1

- Item 2

- Item 3

Unordered list

- Item A

- Item B

- Item C

Bold text

Emphasis

Superscript

Subscript