Convertible note guide for startups [2026]

![Convertible note guide for startups [2026]](https://cdn.prod.website-files.com/67156ce378a3dccbef141a7a/67367b8ecb30b7c7063f5e26_669977d7324fa763cd6905cd_docusign-BbSBf5uv50A-unsplash%203-p-2000.avif)

2 mins

Startups are always looking for funding opportunities. And among the equity-financing types, convertible notes have increased in popularity over the past year, hitting an issuance of $48 billion.

But what exactly are convertible notes, and are they the right choice for your startup? This guide breaks down the essentials of convertible notes, their pros and cons, and how they stack up against alternatives like revenue-based financing.

By the end, you’ll have a clear understanding of convertible notes and be better equipped to make the right funding decisions for your business.

What are convertible notes?

Convertible notes are a type of short-term debt that converts into equity at a later date, typically during a future funding round. They’re essentially startup loans that investors make to startups with the expectation of receiving shares instead of a cash repayment.

These notes have two key components: the principal (the amount invested) and the interest rate. When a specific event occurs, such as a priced equity round, the note converts to equity at a predetermined rate or discount.

Convertible notes allow startups to raise funds quickly without the complexity and cost associated with pricing a round of equity.

However, they’re still a form of equity financing, which is why many startups look for non-equity financing methods. Non-equity financing can help you keep control of your company—or it can provide the funding your company needs to receive in order to prepare for future equity-financing rounds.

Why Do Startups Use Convertible Notes?

Startups may turn to convertible notes for their speed and simplicity. These instruments allow companies to raise funds quickly without the complex negotiations and paperwork associated with traditional equity rounds. They also defer potentially contentious valuation discussions, giving startups more time to establish their worth.

The cost-effectiveness of convertible notes appeals to cash-strapped startups, with lower legal fees compared to priced equity rounds. Investors are attracted by built-in incentives like discounts and valuation caps, which offer potential upside for their early risk-taking.

Convertible notes provide flexibility, allowing terms to be tailored to both startup and investor needs. They can serve as bridge financing, helping startups reach key milestones or extend their runway between larger funding rounds.

Convertible note terms

Let’s break down the most important components of convertible note financing:

Conversion discount

The conversion discount provides early investors with a reduced price per share when the note converts to equity. Typically ranging from 10% to 30%, this discount compensates investors for the higher risk they took by investing early.

For example, a 20% discount means the noteholder pays 80% of the price per share that new investors pay in the next equity round. This feature incentivizes early investment and can result in a larger ownership stake for the noteholder if the company’s valuation increases significantly.

Conversion price

The conversion price determines how many shares the noteholder receives when the note converts to equity. It’s usually the lower of two figures: the price per share in the next equity round minus the conversion discount, or the price per share based on the valuation cap.

This mechanism ensures that early investors get the most favorable terms possible, rewarding them for their early support. The conversion price plays a crucial role in determining the ultimate ownership percentage the noteholder receives.

Valuation

The valuation cap sets a maximum company valuation for the purposes of converting the note to equity. It protects early investors if the company’s value increases dramatically before the next funding round.

For instance, if a note has a $5 million valuation cap and the company raises its next round at a $10 million valuation, the noteholder’s investment converts as if the company were valued at $5 million. This can result in significantly more shares for the noteholder compared to new investors, effectively rewarding them for their early risk.

Interest rate

Convertible notes typically accrue interest, usually at rates between 2% and 8% annually. This interest is not paid out in cash but instead adds to the principal amount that converts to equity.

The interest rate serves as additional compensation for the investor’s risk and increases their potential equity stake. While the interest rate is often lower than traditional loan rates, it still provides a meaningful boost to the investor’s returns, especially if the startup experiences rapid growth.

Maturity date

The maturity date specifies when the convertible note is due for repayment if it hasn’t yet converted to equity. Typically ranging from 18 to 24 months, this date creates a deadline for the startup to either raise a priced equity round (triggering conversion) or repay the note.

In practice, if the maturity date approaches and the company hasn’t raised a new round, the investors and company often agree to extend the maturity date rather than demand repayment. This term balances the investor’s need for a timeframe with the startup’s need for flexibility.

Future financing rounds

Convertible notes usually specify the conditions under which they will convert to equity, typically tied to future financing rounds. Often, notes convert automatically in a "qualified financing"–a new equity round raising a predetermined minimum amount. This ensures that the notes convert when the company has achieved significant growth and can support a proper valuation.

The terms may also include provisions for what happens in other scenarios, such as acquisition or if no qualified financing occurs before the maturity date, providing clarity for all parties involved.

Convertible Note Example

Let’s say a startup raises $500,000 through convertible notes with the following terms

- 5% annual interest rate

- Two-year maturity date

- 20% discount, or

- $5 million valuation cap

Trigger Event (New Funding Round)

One year later, the startup has grown and attracts a new investor:

- New investor offers $1.5 million at a $10 million post-money valuation

- Let’s assume there are 2 million shares in total after the investment

- New share price calculation: $10 million / 2 million shares = $5 per share

- The new investor receives: $1.5 million / $5 = 300,000 shares

Convertible Note Conversion Process

- Calculate accrued interest: $500,000 * 5% * 1 year = $25,000

- Total amount to convert: $500,000 + $25,000 = $525,000

- Determine conversion price (the lower of):some text

- Valuation cap price: ($5 million / $10 million) = 0.5 * new share price = $2.50

- Discount price: New share price * (100% - 20%) = 80% * new share price = $4

- Use the valuation cap price for conversion (more favorable to the note holder) of $2.50

- Determine number of shares: $525,000 / $2.50 = 210,000 shares

Final Cap Table After Conversion

- Founders: 1,490,000 shares, 74.5% ownership

- Convertible Note Holder: 210,000 shares, 10.5% ownership

- New Investor: 300,000 shares, 15% ownership

Based on the startup’s growth trajectory, convertible notes adapt to the investor, ensuring a favorable outcome. This structure provides early investors with downside protection while allowing them to benefit from the company’s growth.

Pros and Cons of Convertible Notes for Startups

Convertible notes offer both advantages and drawbacks for startups, so let’s dive into the pros and cons:

Benefits of convertible note financing

- Faster and simpler than equity rounds

- Defers valuation discussions to later date

- Lower upfront legal costs

- Attractive to early-stage investors

- Maintains founder control in early stages

Convertible notes provide startups with a quick and efficient way to raise capital. The simplified documentation and negotiation process allows companies to secure funding faster than traditional equity rounds. By postponing valuation discussions, startups can avoid potentially contentious negotiations when the company’s worth is still uncertain. This delay can also prevent premature dilution for founders.

The lower legal costs associated with convertible notes are particularly beneficial for cash-strapped early-stage companies. Additionally, features like discounts and valuation caps make these instruments attractive to investors, potentially making it easier for startups to secure funding.

Convertible note financing limitations

- Can lead to complex cap tables

- Potential for significant future dilution

- Interest accrual adds to the company’s debt

- May create uncertainty for future investors

- Still a form of equity financing

Convertible notes can result in complex cap tables, especially if multiple notes with different terms are issued. This complexity can potentially complicate future funding rounds or exit negotiations.

The delayed nature of conversion can lead to significant dilution in future rounds, particularly if the company’s value increases substantially. This can catch founders off guard if they haven’t carefully modeled potential outcomes.

While the interest rates on convertible notes are typically lower than traditional loans, the accruing interest still adds to the company’s debt and ultimately increases the amount of equity that will be issued upon conversion.

The presence of convertible notes can create uncertainty for potential future investors, who may find it challenging to assess the company’s capitalization structure accurately.

For early-stage startups, particularly those with recurring revenue, there may be better alternative financing options to consider. Revenue-based financing, for instance, offers non-dilutive capital without the complexities and potential dilution associated with convertible notes.

Alternatives to Convertible Notes

If you’re an early-stage startup looking for financing and aren’t sold on convertible notes, here are some of the best alternative financing options:

- Convertible Note vs Revenue-based Financing

Revenue-based financing (RBF) is a funding model where companies receive capital in exchange for a percentage of their future revenue until a predetermined amount is repaid. Unlike convertible notes, RBF doesn’t convert to equity, making it a truly non-dilutive financing option.

Pros:

- Non-dilutive — founders retain full ownership

- No valuation required

- Faster access to capital

- Great for recurring revenue companies

- Helps early-stage startups scale

Cons:

- Typically requires consistent revenue

- May impact cash flow in the short term

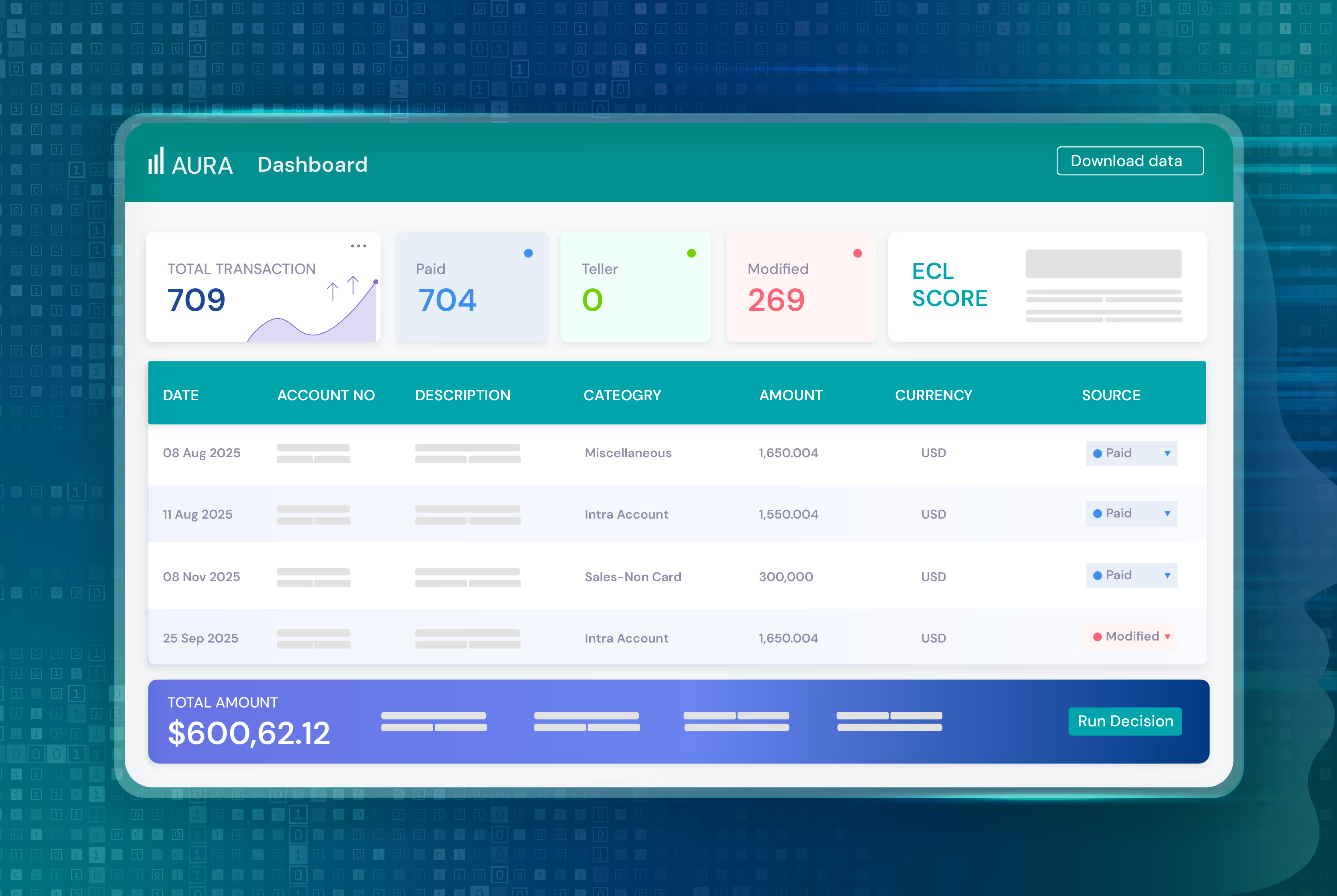

Efficient Capital Labs (ECL) offers a unique revenue-based funding model specifically for SaaS companies. With ECL, startups can access up to $2 million in non-dilutive capital within just three days. ECL’s approach features a straightforward fee structure (10-14% flat annual fee for USD funding), no hidden costs, and no collateral requirements.

If you’re looking for SaaS funding without giving up equity or control, ECL’s RBF provides some of the best rates on the market, making it an ideal partner for your financing.

Ready to explore non-dilutive funding for your startup? Apply now with ECL and get the capital you need to scale your business.

- Convertible Note vs SAFE

A SAFE (Simple Agreement for Future Equity) is a financing instrument designed to streamline early-stage investments. Introduced by Y Combinator in 2013, SAFEs are contracts that grant investors the right to receive equity in a future funding round, but without setting a specific price per share at the time of initial investment.

Unlike convertible notes, SAFEs are not debt instruments. They don’t accrue interest or have a maturity date. Instead, they automatically convert to equity when a triggering event occurs, typically a priced equity round. The conversion terms are usually based on a valuation cap or discount rate, similar to convertible notes.

Pros:

- Simpler structure than convertible notes

- No interest accrual or maturity date

- Can be executed quickly with minimal negotiation

- More company-friendly in some aspects (e.g., no threat of default)

Cons:

- May be less familiar to some investors, especially outside of tech hubs

- Lack of maturity date can lead to indefinite waiting for conversion

- Potential for complex cap table if multiple SAFEs are issued with different terms

- May not be suitable for all jurisdictions due to regulatory differences

- Can lead to unexpected dilution if not carefully managed

- Convertible Note vs Equity

Traditional equity financing involves selling shares of the company to investors at an agreed-upon valuation. While both convertible notes and equity result in investors owning a piece of the company, the process and timing differ significantly.

Pros:

- Clear ownership structure from the outset

- No debt on the company’s balance sheet

- Can bring in strategic investors with voting rights

- Potentially larger funding amounts

Cons:

- Immediate dilution for founders

- Requires setting a valuation early on

- More complex and time-consuming process

- Higher upfront legal costs

- May involve giving up some control (board seats, voting rights)

Learn more about convertible notes

Before you decide on a financing model, let’s explore some of the most common questions about convertible notes.

What is a cap in a convertible note?

A cap in a convertible note sets a maximum valuation at which the note will convert to equity. It protects early investors if the company’s value increases significantly before the next funding round. For example, if a note has a $5 million cap and the company raises at a $10 million valuation, the note converts as if the company were valued at $5 million, giving the noteholder more shares for their investment.

Can a convertible note be paid back?

Yes, convertible notes can be paid back, typically at maturity if they haven't converted to equity. However, this is often not the preferred outcome for either the company or the investors. Usually, if a note is approaching maturity without having converted, the parties will negotiate an extension or conversion rather than opting for repayment.

Is a convertible note debt or equity?

A convertible note is a hybrid instrument that starts as debt but is designed to convert into equity. Initially, it’s structured as a loan, but unlike traditional debt, the expectation is that it will convert to equity in a future funding round. That’s why it can offer some of the protections of debt with the upside potential of equity.

What happens to a convertible note if startup fails?

If a startup fails, convertible noteholders are typically treated as creditors of the company. In a liquidation scenario, they would stand in line behind other creditors but ahead of equity holders. However, in many startup failures, there are often few or no assets left to distribute, meaning noteholders may recover little or nothing from their investment.

Do convertible notes get paid back?

Convertible notes are designed with the expectation that they will convert to equity rather than be paid back in cash. However, if the note reaches its maturity date without converting, the company may be obligated to repay the principal plus accrued interest. In practice, it’s more common for the parties to agree to extend the note or convert it to equity rather than seek repayment.

Can you cash out a convertible note?

Generally, convertible notes are not designed to be cashed out early. They typically convert to equity in a priced round or become due at maturity. However, in some cases, if allowed by the note's terms and agreed upon by the company, an investor might be able to sell their note to another investor. This is not common and would depend on the specific terms of the note and the willingness of all parties involved.

Are convertible notes good for startups?

Convertible notes can be beneficial for some startups, particularly in early funding stages. They offer advantages such as simplified paperwork, deferred valuation discussions, and potential investor incentives. However, they’re not universally ideal for all startups.

For many startups, particularly those with established revenue streams, there may be more advantageous financing options available. Revenue-based financing, for instance, offers a non-dilutive alternative that gives your company the financing to scale without straining cash flow.

With Efficient Capital Lab’s (ECL) revenue-based financing for SaaS companies, you can rest assured that you’re getting the fastest funding possible. And because ECL has its own $100M debt facility, the rates on your financing can be some of the lowest on the market.

If you want to access up to $2 million in growth capital in just three days, apply now with ECL and discover a smarter way to fund your startup’s success.

![Convertible note guide for startups [2026]](https://cdn.prod.website-files.com/67156ce378a3dccbef141a7a/675733c091a90dab102096fc_ecl-madeline.avif)