What is Invoice Factoring and How Does it Work? [2025]

2 mins

While the invoice factoring market is small compared to other financing alternatives such as venture capital and merchant cash advances, it’s still a significant portion of the lending market.

But what exactly is invoice factoring and is it right for your startup?

In this guide, we’ll break down everything you need to know about invoice factoring, from benefits and costs to alternatives.

Let’s dive in.

What is Invoice Factoring?

Invoice factoring is a financial transaction in which a business sells its outstanding invoices to a third-party factoring company at a discount. In exchange for the invoices, the business receives immediate cash, typically ranging from 70% to 90% of the total invoice value.

The factoring company then takes responsibility for collecting payment from the business’s customers. Once the customers pay the invoices, the factoring company sends the remaining balance to the business minus a factoring fee.

Invoice factoring allows businesses to convert their unpaid invoices into quick cash, improving their cash flow and enabling them to meet short-term financial obligations without taking on additional debt.

What is a Factoring Company?

A factoring company is a financial institution that specializes in providing invoice factoring services. These companies purchase outstanding invoices from businesses and provide them with immediate cash in exchange.

Factoring companies then assume the responsibility of collecting payment from the businesses’ customers. They typically offer two types of factoring arrangements:

- Recourse factoring: In this arrangement, if the customers fail to pay the invoices, the business is required to buy back the unpaid invoices from the factoring company.

- Non-recourse factoring: In this arrangement, the factoring company assumes the risk of non-payment by the customers, providing the business with additional protection against bad debts.

Invoice Factoring Example

Let’s consider a B2B SaaS startup that provides cloud-based project management software to enterprise clients. The startup has issued invoices totaling $100,000 to its customers, with payment terms of 60 days. To meet its immediate cash flow needs and shorten the cash conversion cycle, the startup decides to use invoice factoring.

The startup submits the outstanding invoices to a factoring company, which approves the invoices and advances 80% of the total value, or $80,000, to the startup. The factoring company then collects payment from the startup’s customers.

When the customers pay the full $100,000, the factoring company sends the remaining $20,000 to the startup, minus a 3% factoring fee of $3,000. In the end, the startup receives a total of $97,000 from the factoring arrangement.

About the Invoice Factoring Market

Let’s take a look at the invoice factoring market throughout the globe.

Invoice Factoring in the United States

The United States has a well-established and mature invoice factoring market, with numerous factoring companies serving businesses of all sizes and industries. The domestic segment accounted for the largest market share of 77.2% in 2021, driven by the rapid adoption of factoring receivable methods in major industries due to its effectiveness.

The increasing use of electronic invoices and government efforts to boost private consumption have also contributed to the growth of the factoring market in the United States, with the overall factoring services market estimated to be growing by 8.1% each year.

India’s Invoice Factoring

India’s invoice factoring market is experiencing growth due to the rise in open account trading opportunities and the need for cash flow management and alternative financing sources for small and medium-sized enterprises (SMEs).

In India, banks dominate the invoice factoring market, accounting for more than four-fifths of the market revenue in 2019. This is attributed to the secure factoring services provided by banks, with minimum chances of fraud.

Invoice Factoring in Singapore

Singapore’s invoice factoring market is driven by the country’s strong trade relationships and its position as a global financial hub. The market is well-developed, with a mix of local and international factoring companies serving businesses across various industries.

The Singaporean government has also taken steps to support the growth of the invoice factoring market, such as introducing the Monetary Authority of Singapore’s Finance Company Act, which provides a regulatory framework for factoring companies operating in the country.

How Does Invoice Factoring Work?

Invoice factoring is a straightforward process that involves selling outstanding invoices to a factoring company in exchange for immediate cash. The factoring company then collects payment from the business’s customers, and the business receives the remaining balance minus the factoring fee.

Steps of Invoice Factoring

1. The business provides goods or services to its customers and issues invoices with payment terms typically ranging from 30 to 90 days.

2. The business submits the outstanding invoices to the factoring company for approval.

3. The factoring company reviews the invoices and the creditworthiness of the business’s customers, typically approving the invoices within 24 to 48 hours.

4. Upon approval, the factoring company advances a percentage of the total invoice value, usually 70% to 90%, to the business.

5. The factoring company takes responsibility for collecting payments from the business's customers.

6. When the customers pay the invoices, the factoring company sends the remaining balance to the business minus the factoring fee.

Invoice Factoring Costs

The cost of invoice factoring primarily consists of the factoring fee, which typically ranges from 1% to 5% of the total invoice value. The exact fee depends on various factors, such as the volume of invoices, the creditworthiness of the business’s customers, and the payment terms of the invoices.

In addition to the factoring fee, some factoring companies may charge additional fees, such as:

- Application fees

- Invoice processing fees

- Service fees

- Late payment fees

Invoice Factoring vs Invoice Financing vs Invoice Discounting vs Accounts Receivable Financing

While these terms are often used interchangeably, there are some differences between invoice factoring, invoice financing, invoice discounting, and accounts receivable financing. For instance, unlike invoice factoring, invoice financing involves businesses using their outstanding invoices as collateral to obtain a startup loan from a lender. The business remains in charge of collecting payments from its customers and must repay the loan to the lender.

Invoice discounting is similar to invoice financing, but the business keeps control over its sales ledger and customer relationships. The lender provides funding based on a percentage of the outstanding invoices, while the business is responsible for collecting payment and repaying the lender.

Accounts receivable financing is a broader term that includes various financing solutions based on a business’s outstanding invoices, such as invoice factoring, invoice financing, and invoice discounting.

Invoice Factoring Advantages and Disadvantages

When considering invoice factoring as a financing solution, weighing the advantages and disadvantages is essential to determine if it’s the right choice for your startup.

Benefits of Invoice Factoring

- Immediate cash improves cash flow, helping startups meet financial obligations and invest in growth.

- Selling invoices rather than borrowing money means no debt is added to the business’s balance sheet.

- Factoring arrangements are customizable, allowing startups to factor all or part of their invoices.

- Invoice factoring companies handle collections, reducing the business’s administrative burden.

- Factoring is often easier to qualify for than traditional financing since approval depends on the creditworthiness of the customers, not the business.

Invoice Factoring Limitations

- Factoring can be more expensive than other forms of financing, with fees ranging from 1% to 5% of the invoice value - when this cost is translated into an APR, which is typically used to evaluate the price of lending over a time period, factoring can be very expensive.

- Startups might lose some control as factoring companies could interact directly with their customers to recover an unpaid invoice amount.

- In recourse factoring, the business may have to buy back unpaid invoices, which can strain finances.

- The approval and terms for factoring depend heavily on the creditworthiness of the customers, which can limit options for organizations with less creditworthy clients.

Best Alternatives to Invoice Factoring: Quick Overview

While invoice factoring could work for some startups, it’s not going to be the right fit for all of them. For invoicing factoring to be a helpful funding option, you need to have a solvable cash flow problem.

Let’s say you're a manufacturing company and you need more capital to produce more product because the demand is there. That's where invoice factoring makes the most sense: you can get cash upfront for the invoices that need to be paid, expedite your production, and then pay back the factoring company without taking on long-term debt.

However, if your business can't quickly address the cash flow problem (such as if there’s low demand or high churn, etc.), invoice factoring will just put a band-aid on the issue–not fix it. This means you might find better success with some other funding options.

Best Alternatives to Invoice Factoring: Complete Review

Here’s an in-depth look at the alternatives to invoice factoring:

- Revenue-based Financing

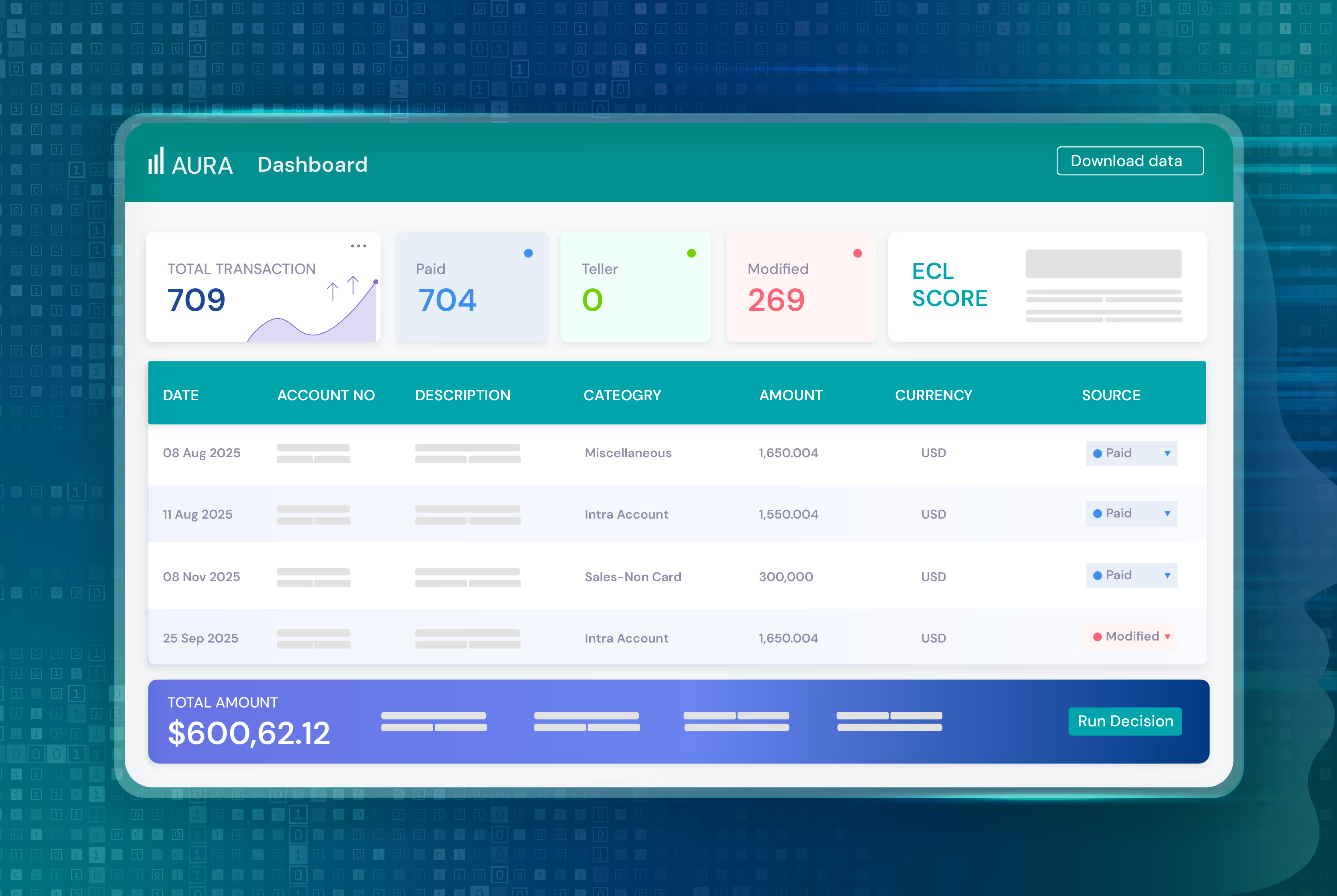

Revenue-based financing (RBF) is a type of funding where businesses receive capital upfront in exchange for a fixed percentage of their future revenue over a set period, typically 12-24 months. RBF companies like Efficient Capital Labs (ECL) offer a straightforward funding model with a clear repayment structure based on a flat fee, rather than a fluctuating percentage of revenue.

Pros:

- No dilution of ownership or loss of control

- Quick access to funds, often within 3-5 days

- Fixed repayment terms for predictable budgeting

- No collateral or warrants required

- Approval based on business performance, not personal credit

Cons:

- Requires a minimum monthly revenue to qualify

- Shorter repayment terms than some other financing options

Invoice Factoring vs Revenue-based Financing

RBF offers more flexibility than invoice factoring because it doesn’t require businesses to have large volume of B2B invoices. Additionally, RBF allows businesses to maintain control over their customer relationships since the RBF provider is not involved in the invoice collection process.

ECL’s RBF model is well-suited for SaaS companies and other businesses with recurring revenue streams. With funding available in as little as 72 hours and a simple, transparent fee structure (10-12% for USD funding, 12-15% for INR funding), ECL empowers businesses to scale quickly without sacrificing equity or control.

Get up to $1.5 million in funding for your SaaS business in three days

- Invoice Financing

Invoice financing, which we reviewed above, is a type of funding where businesses use their outstanding invoices as collateral to secure a loan from a lender. The lender provides a percentage of the invoice value upfront, typically 80-90%, and the business repays the loan plus interest and fees when the invoices are paid by their customers.

Pros:

- Retain control over customer relationships

- Flexibility to finance a portion of invoices

- May be less expensive than invoice factoring

Cons:

- May require a personal guarantee

- Loan repayment is the responsibility of the business

- Risk of defaulting on the loan if invoices are not paid

Invoice Factoring vs Invoice Financing

The main difference between invoice factoring and invoice financing is that with invoice factoring, the business sells the invoices to the factoring company. With invoice financing, the business retains ownership of the invoices and uses them as collateral for a loan.

- Merchant Cash Advances

A merchant cash advance (MCA) is a type of funding where businesses receive a lump sum in exchange for a percentage of their future credit card sales. Repayment is typically made through daily or weekly deductions from the business’s credit card sales.

Pros:

- Quick access to funds

- No collateral required

- Easier to qualify than traditional loans

Cons:

- High cost with APRs ranging from 20% to 80%

- Daily or weekly repayments can strain cash flow

- May require a personal guarantee

Invoice Factoring vs Merchant Cash Advances

While both invoice factoring and MCAs provide access to capital without collateral, they differ in their repayment structure and cost. Invoice factoring is based on specific invoices and has a lower cost than MCAs. However, MCAs may be easier to qualify for and they don’t require the business to have B2B invoices.

- Bank Loans

Bank loans are a traditional form of financing where businesses borrow a lump sum from a bank and repay it over a set term with interest. Bank loans can be secured by collateral or unsecured, depending on the lender and the borrower’s creditworthiness.

Pros:

- Lower interest rates than alternative financing options

- Longer repayment terms

- Builds business credit

Cons:

- Strict qualifications based on credit, collateral, and time in business

- Lengthy application process

- May require a personal guarantee

Invoice Factoring vs Bank Loans

Invoice factoring and bank loans serve different purposes for businesses. Invoice factoring provides quick access to cash based on outstanding invoices, while bank loans provide a lump sum for general business purposes.

Bank loans typically have lower interest rates and longer repayment terms than invoice factoring, but they also have stricter qualifications and a longer application process, which may not make them the best fit for companies like startups.

More About Invoice Factoring

Let’s take a look at some common questions to help you better understand this financing option.

Is invoice factoring a good idea?

Invoice factoring can be a good idea for businesses that need quick access to cash and have a large amount of outstanding invoices. It’s especially useful for B2B companies with long payment terms and creditworthy customers.

However, it’s essential to consider the cost and potential impact on customer relationships.

What is the average cost of invoice factoring?

The average cost of invoice factoring varies depending on the provider, the industry, and the creditworthiness of the business’s customers. Typically, factoring fees range from 1% to 5% of the invoice value.

Some providers may also charge additional fees, such as application fees or invoice processing fees. It’s crucial to carefully review the terms and conditions of the factoring agreement to understand the total cost.

Is invoice factoring considered debt?

No, invoice factoring is not considered debt because the business sells its outstanding invoices to the factoring company rather than borrowing money. This means that invoice factoring does not create debt on the business’s balance sheet, which can be advantageous for businesses looking to maintain a strong financial position with investors.

How do I get out of invoice factoring?

To get out of an invoice factoring arrangement, the business typically needs to fulfill its contractual obligations and provide written notice to the factoring company. The specific steps to terminate the agreement may vary depending on the terms of the contract. However, invoice factoring can often keep you in a cycle—if your cash conversion cycle isn’t optimized by the time you finish your invoice factoring term, you’ll still be stuck with negative cash flow, leading to more invoice factoring.

Should You Use Invoice Factoring For Your Business?

Invoice factoring can provide immediate cash flow improvements and free up resources without adding debt to your balance sheet. However, it may come with higher costs compared to other financing options and could affect your customer relationships if the factoring company takes over collections.

For businesses that might find these aspects of invoice factoring less appealing or whose circumstances do not align with the typical requirements of factoring, revenue-based financing (RBF) offered by Efficient Capital Labs (ECL) can be a great alternative.

RBF allows you to leverage a fixed percentage of your future revenues to obtain funding, providing a straightforward repayment plan based on your business’s actual earnings, without needing to manage or sell invoices.

Get funding up to $1.5 million with no-hassle and zero hidden fees

Heading 1

Heading 2

Heading 3

Heading 4

Heading 5

Heading 6

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Block quote

Ordered list

- Item 1

- Item 2

- Item 3

Unordered list

- Item A

- Item B

- Item C

Bold text

Emphasis

Superscript

Subscript