What is a Revenue Based Loan?

-p-2000.avif)

2 mins

With the alternative financing market valued at over $10 billion in 2022 and projected to reach over $40 billion by 2032, it’s clear that startup founders are seeking more flexible and founder-friendly funding solutions.

Revenue-based loans are exactly how they sound: they’re loans based on revenue. Often, revenue-based loans are confused with revenue-based financing. But, they’re not the same offering.

In this comprehensive guide, we’ll explore the ins and outs of revenue-based loans, how they differ from RBF, and the best financial option for your startup.

What are revenue-based loans?

Revenue-based loans are a type of business loan that provides capital to startups and growing businesses based on their recurring revenue. This financing model uses a company’s monthly recurring revenue (MRR) or annual recurring revenue (ARR) to determine the amount and repayment terms.

Revenue-based loans vs revenue-based financing

To start with, “loans” and “financing” are two different terms. “Financing” as a general term refers to any type of equity or debt finding–including venture capital, bank loans, and more. A loan is a subset of the financing umbrella. In the US - loans typically involve a principal amount and an interest rate - and no equity is exchanged.

A revenue-based loan is simply a loan from a lender that considers revenue as one of the underwriting criteria. The loan then must meet the requirements outlined by the contract and be provided by a legal lender.

Revenue-based finance is another type of financing which refers to lending based on revenue. It is often not a loan from a contractual and legal perspective. For revenue-based finance, providers often look at a company’s recurring revenue, and make a lending offer based on providing cash upfront on that company’s predicted future revenue streams.

Benefits of Revenue-based Financing

There are a few benefits of accessing revenue-based financing–whether or not you access that financing with a loan.

Non-dilutive capital

Unlike equity financing, which requires founders to give up a portion of their ownership in exchange for funding, revenue-based financing allows startups to retain control of their companies. This is particularly valuable for founders who want to maintain their equity stake and decision-making power as they grow their business.

By opting for this alternative type of financing, startups can access the capital they need to scale without diluting their ownership or compromising their long-term vision.

Faster access to funds

RBF often has streamlined application processes and faster approval times compared to traditional bank loans or equity financing rounds. Lenders specializing in these types of funding typically have a deep understanding of the unique needs and challenges of startups, allowing them to make quick and informed decisions about approvals.

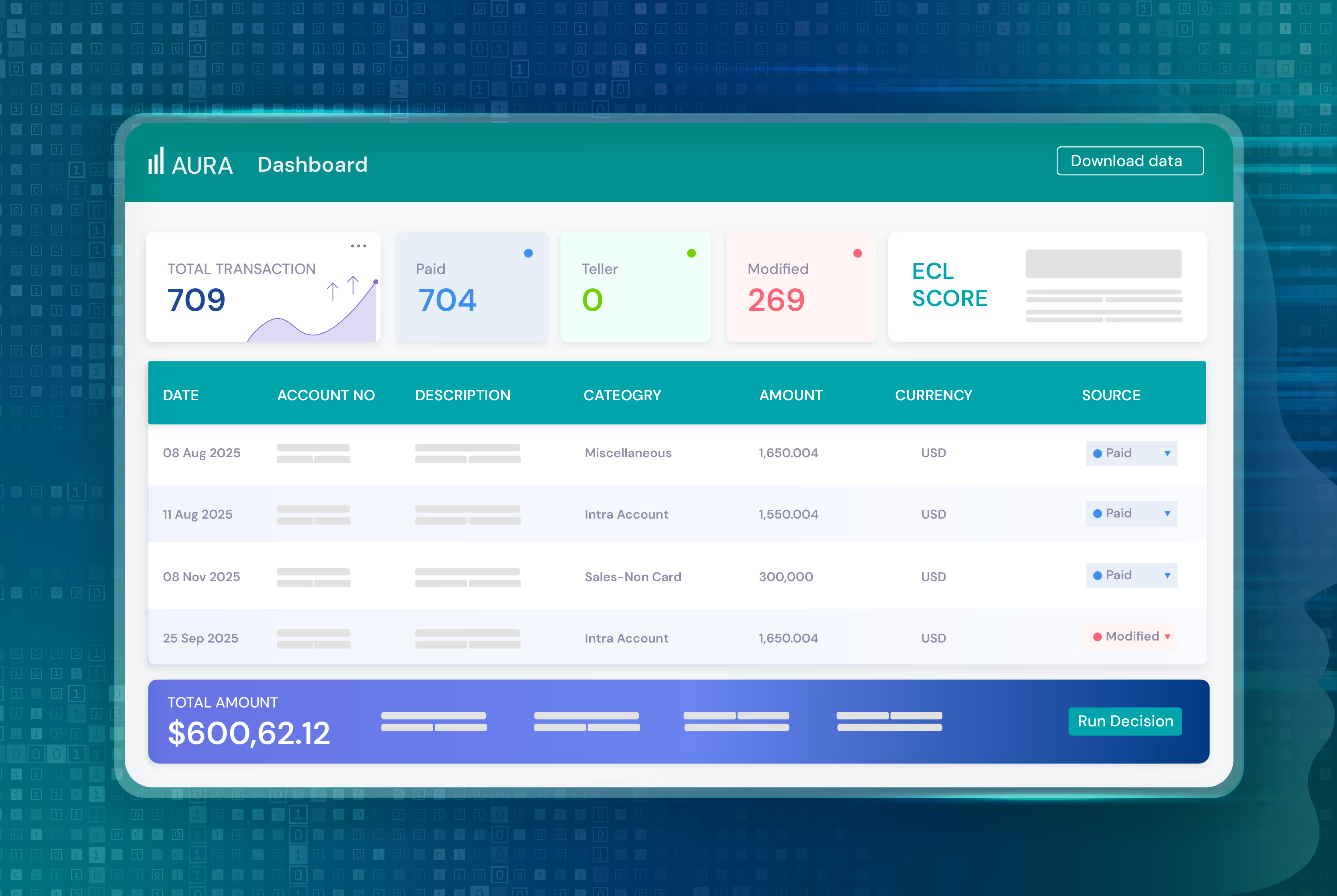

This means that startups can access the funds they need to grow their business in a matter of days or weeks, rather than the months it may take to secure a traditional bank loan or close an equity financing round. For example, Efficient Capital Lab’s (ECL) quick and simple application process for RBF gives startups access to up to $2 million in funding in just 72 hours.

Scalability

RBF is designed to scale with the growth of the borrower’s business. As a startup’s recurring revenue increases, they may become eligible for larger funding amounts or more favorable terms. This scalability allows startups to access additional capital as they need it—without having to go through a lengthy reapplication process or renegotiate terms.

The alignment between the funding and the company’s revenue performance also means that startups can better manage their cash flow during periods of growth or contraction.

Revenue-based Loan and Financing Limitations

While revenue-based loans and financing offer many benefits for startups and growing businesses, it might not be the best fit for some startups.

Revenue is required

Lenders typically require borrowers to have a minimum MRR or ARR to qualify for a revenue-based loan. Early-stage startups that have not yet established a stable revenue stream may not be eligible.

The focus on recurring revenue can also make revenue-based loans more suitable for businesses with subscription-based or predictable revenue models, such as SaaS companies, rather than those with more variable or transactional revenue streams.

Short-term repayments

Another potential drawback of revenue-based loans is that they often have shorter repayment terms compared to traditional bank loans. A relatively short repayment window can be challenging for some startups, particularly those with longer sales cycles or those that require more time to generate a return on their investments.

Best Revenue-based Funding for Startups

If you’re still unsure which revenue-based funding is best for you, here’s a breakdown of the most common financing options available:

Revenue-based financing with ECL

ECL is a leading provider of revenue-based financing for SaaS startups. ECL offers a founder-friendly alternative to traditional debt and equity financing, providing startups with up to $2 million in non-dilutive capital.

With a focus on speed, simplicity, and transparency, ECL’s revenue-based financing model is designed to align with the unique needs and challenges of SaaS startups. By basing funding decisions on a company’s recurring revenue and growth potential, ECL is able to provide capital quickly and efficiently, with funding available in as little as 72 hours.

The application process is straightforward and requires no collaterals or dilution of equity. And with a repeat customer rate of over 75%, SaaS companies have been consistently choosing ECL for their financing needs.

Get funded in 72 hours with ECL

Pros:

- Non-dilutive capital up to $2 million

- Funding available in as little as 72 hours

- Simple, transparent pricing with flat fees and no hidden costs

- No warrants or collateral required

- Predictable repayment terms

Cons

- Best for SaaS startups with recurring revenue

- Funding amounts may be lower compared to equity financing options

Venture Debt

Venture debt is a form of debt financing that is typically available to startups that have recently raised a round of equity financing. Venture debt lenders provide capital in the form of a loan, which is secured by the startup’s assets and intellectual property. The loan is usually structured as a term loan with a fixed interest rate and repayment period.

Pros:

- Non-equity financing that can extend a startup’s runway

- Allows startups to access additional capital without further diluting equity

- Can be used in conjunction with equity financing

Cons

- Usually requires a recent equity funding round to qualify

- Often requires warrants which can result in equity dilution if exercised

- Higher interest rates compared to traditional bank loans

Traditional Bank Loans

Traditional bank loans are a form of debt financing provided by banks and other financial institutions. Startups can apply for various types of bank loans, such as term loans or SBA loans, which are typically secured by the company’s assets or personal guarantees from the founders.

Pros:

- Non-dilutive capital with fixed repayment terms

- Suitable for startups with strong financials and collateral

Cons

- Strict eligibility requirements and lengthy application processes

- Often requires personal guarantees or collateral

- May not be available to early-stage startups without established financial history

Business Line of Credit

A business line of credit is a flexible financing option that allows startups to borrow funds up to a predetermined credit limit. Startups can draw from the line of credit as needed and only pay interest on the amount borrowed. As the borrowed funds are repaid, the credit line becomes available for use again.

Pros:

- Flexible financing option that can be used for various business needs

- Only pay interest on the amount borrowed

- Can help manage cash flow fluctuations

Cons

- Requires strong financials and credit history to qualify

- Interest rates may be higher compared to traditional bank loans

- May require personal guarantees or collateral

Invoice Factoring

Invoice factoring is a form of financing where your company sells its outstanding invoices to a factoring company at a discount. If you’re having cash flow issues and use invoicing, invoice factoring allows you to get the capital you need, shortening your cash conversion cycle and giving you the opportunity for growth.

Pros:

- Provides quick access to cash based on outstanding invoices

- Does not require collateral or personal guarantees

- Can help improve cash flow and manage accounts receivable

Cons

- Only suitable for startups with B2B invoices

- Factoring fees can be high, ranging from 1% to 5% of invoice value

- May impact customer relationships as the factoring company collects payments directly

How to Apply for Revenue-based Financing with ECL

Verify your eligibility

Before applying, ensure that your startup meets ECL’s eligibility criteria. ECL works with SaaS startups that have a minimum of $100,000 in ARR and more than six months of revenue history.

Complete the online application

Visit ECL’s website and fill out the online application form, providing basic information about your startup, such as company name, contact details, and revenue metrics.

Connect your financial accounts

During your application, you’ll be asked to submit your financial documents. Depending on the bank and payment processor you use, you’ll either connect seamlessly or need to enter in some information.

Review and accept your funding offer

Once ECL has reviewed your application and financial data, they will present you with a funding offer. Review the terms, including the funding amount, flat fee, and repayment schedule. If you accept the offer, you’ll proceed to the final stage of the application process.

In the case that you need a higher funding amount, you will have the opportunity to apply for future tranches of funding as needed. For businesses who do not qualify, they will be able to apply again in the future.

Complete due diligence and receive funding

ECL will conduct a final round of due diligence to verify your startup’s information and financial health. Once complete, you’ll sign the financing agreement, and ECL will transfer the funds to your startup’s bank account within 72 hours.

Choose the best revenue-based financing opportunity for your startup

Among your options for financing your startup, Efficient Capital Labs (ECL) stands out as the premier choice for SaaS startups. ECL’s founder-friendly approach, transparent pricing, and easy application process make it an attractive option for startups seeking fast and flexible financing.

With ECL, startups can access up to $2 million in non-dilutive capital, with funding available in as little as 72 hours. The simple, flat-fee pricing structure and predictable 12-month repayment term make it easy for startups to manage their cash flow and plan for growth.

Get funded in 72 hours with ECL